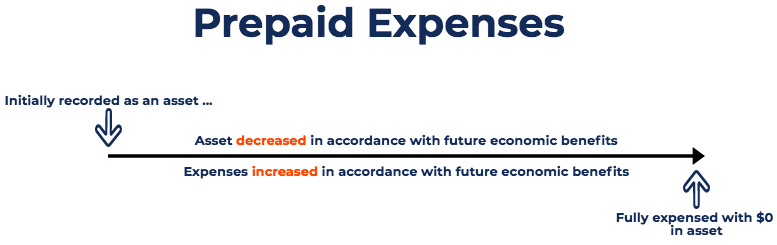

If the service or product covers several periods, then the company allocates the expense throughout each period it realizes the benefits. A company most commonly records the expenses of a prepaid purchase in the accounting period that the company realizes the benefits of the purchase. The accounting department doesn't recognize these expenses until a later accounting period. This means that even though the business paid the expense upfront, it's not an expense yet in its financial records.

ACOOUNTING TERM FOR PREPAID ORDERS HOW TO

Related: How To Plan for Your Future (And Why It's Important) How to record prepaid expensesĪ company initially records prepaid expenses as an asset in its accounting books and balance sheets. This means when the child is ready for college, the family has already paid for it. For example, if a family creates a college savings plan for their child, each year until the child goes to college, the family can purchase tuition units. This means a company may think about its purchases and accounting ramifications before choosing to use a prepaid expense.Īdditionally, these expenses can benefit individuals because they can help with plans, such as health insurance or savings plans. These expenses can benefit the company because it can help them save money and it can record them as tax deductions within compliance with the tax deduction rules about how a business can write them off. Prepaid expenses benefit the company and individuals. Related: Your Guide to Careers in Finance Who benefits from prepaid expenses?

A few other prepaid expenses a company may have include: Even though the company pays the expense upfront in January, the insurance may provide coverage, which is the value, throughout the remaining months of the year. Goods or services that incur prepaid expenses can generally provide value over an extended amount of time.įor example, a company may purchase vehicle insurance for its company cars in January of the calendar year. Typically, a company may record this type of expense as an asset on its balance sheet, which is expenses on the company's income statement. What are prepaid expenses?Ī prepaid expense is when a company makes a payment for goods or services that it hasn't used or received yet. In this article, we discuss what a prepaid expense is, who benefits from them and how to record them for a business, then offer some examples. Understanding how to record these expenses can ensure that a company's accounting books remain up to date with important financial information. If you're an accountant, you may handle these expenses and record them. One type of expense that businesses often incur is prepaid expenses, which happens when a company pays in advance for goods or services.

0 kommentar(er)

0 kommentar(er)